Category Archives: Estate Planning

Can I Leave Money To Charity Through My Will?

Are you interested in supporting a good cause through your estate? You may be wondering: Can I leave money to a charity using my Will? The short answer is “yes”—though, depending on the amount and the purpose, a charitable trust can sometimes be a better option. Within this article, our Boston estate planning attorney… Read More »

Bring In The New Year With A Review Of Your Estate Plan

According to the AARP, the majority of Americans do not have an estate plan in place. If you have a comprehensive estate plan, you are doing better than most—but you might not be properly protected. An estate plan that has fallen out-of-date may not protect your interests or achieve your goals. Here, our Boston… Read More »

Do You Still Need An Estate Plan If You Are Married?

According to data from Statistics Atlas, approximately half of adults in Massachusetts are currently married. You may be wondering: Do I still need an estate plan if I am married? While it is an understandable question—you may want to simply grant all rights to your spouse—the answer is a clear and resounding “yes.” All… Read More »

Estate Planning In Massachusetts: What Is Portability?

Tax planning is an important part of estate planning—especially for high net worth individuals. As explained by the Internal Revenue Service (IRS), the federal estate tax is “a tax on your right to transfer property at your death.” That being said, most people do not have a federal estate tax liability because the tax… Read More »

What Is A Generation Skipping Trust (GST)?

Many people want to provide support for family members as part of their estate plan. Grandchildren are among the most common people named as heirs in Last Wills and Testaments and selected as beneficiaries in trusts. In some cases, a specialized type of irrevocable trust called a Generation Skipping Trust (GST) may be the… Read More »

Estate Planning: Does A Trust Fully Protect Assets From Creditors?

Asset protection is a core part of estate planning. When used properly, a trust can be one of the most effective and efficient asset protection tools. You may be wondering: Will a trust fully protect assets from creditors? The answer is “it depends on what type of trust you have—only some types of trusts… Read More »

Do I Need A Power Of Attorney?

A Durable Power of Attorney is an essential document in an estate plan and should never be omitted. Many believe they only need a Last Will and Testament, but without a Durable Power of Attorney and other similar documents, your loved ones may need to petition the Probate Court and appear before a judge… Read More »

The Differences Between A Revocable And Irrevocable Trust

Placing assets in a trust is one of the best ways to plan for your estate. There are two broad categories of trust instruments: revocable and irrevocable trusts. Each comes with their own advantages and disadvantages, and an experienced estate planning attorney can help you determine which is best for your situation. At Fisher… Read More »

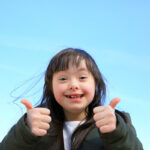

Picking The Right Special Needs Trust

Planning for the future is important, particularly if you have a loved one with physical or mental disabilities. One way to provide for their future after you are gone is through the establishment of a special needs trust. There are two main types of special needs trusts, each with their own benefits and drawbacks,… Read More »

Do Nursing Home Residents Have Any Rights?

If you are considering nursing home care for yourself or a loved one, you may be concerned about maintaining your autonomy and may question whether residents have any rights. Under the 1987 Nursing Home Reform Act, nursing home residents do have certain rights that must be guaranteed. The following article will provide a brief… Read More »